KEY POINTS

- Zimbabwe faces persistent inflation due to excessive money printing and fiscal deficits.

- Inflation erodes purchasing power, increases poverty, and threatens economic stability.

- Solutions require monetary reform, fiscal discipline, and economic diversification.

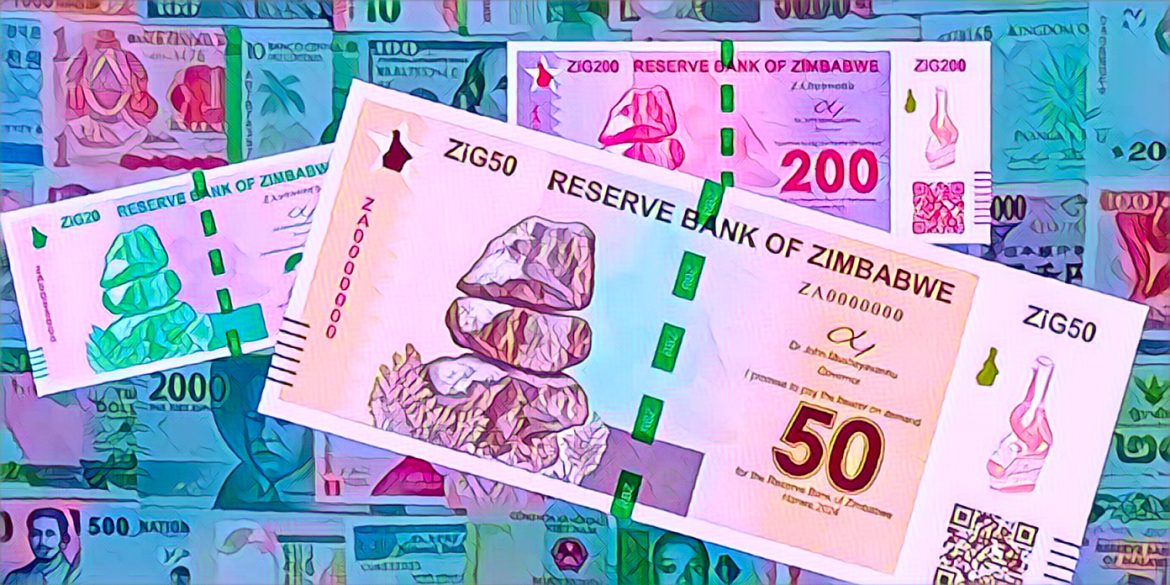

Zimbabwe’s inflation crisis is a stark reminder of the challenges faced by economies grappling with monetary instability. Over the past few decades, the nation has experienced bouts of hyperinflation, with the most infamous episode occurring between 2000 and 2008.

During this period, Zimbabwe’s inflation rate skyrocketed to an estimated 89.7 sextillion percent (8.97 × 10²²), peaking at 79.6 million percent in November 2008. Hyperinflation rendered the local currency effectively worthless, making it nearly impossible to accurately measure after the government ceased reporting official inflation statistics.

This crisis forced a shift to foreign currencies, such as the US dollar, to stabilize the economy. Despite these measures, inflation remains a persistent issue, deepening economic hardships for millions to this day.

Let’s explore the roots of Zimbabwe’s inflation, its far-reaching impacts, and potential pathways to sustainable recovery.

Causes of inflation

- Monetary policy: excessive money printing and expansionary policies

One of the primary drivers of inflation in Zimbabwe is its monetary policy, characterized by the excessive printing of money. This approach, often employed to fund government spending and settle domestic debts, has flooded the economy with excess liquidity, devaluing the Zimbabwean dollar. Without adequate production or foreign reserves to back this issuance, inflation spirals. This trend echoes the early 2000s when unchecked money printing fueled hyperinflation. A reliance on short-term fixes undermines confidence in the currency, driving locals and businesses to seek refuge in stable foreign currencies, further weakening the Zimbabwean dollar. - Fiscal policy: large budget deficits and government spending

Zimbabwe’s chronic budget deficits result from high government expenditure often outpacing revenue collection. Subsidies, public sector wages and debt repayments have strained the treasury. To cover these deficits, the government resorts to borrowing or printing money, both of which stoke inflationary pressures. Coupled with limited fiscal discipline, these practices erode public trust in the government’s ability to manage the economy effectively. Implementing fiscal austerity measures remains politically contentious but is necessary to address the root causes of persistent inflation. - Foreign exchange shortages

Zimbabwe’s foreign exchange reserves have dwindled over time, constraining its ability to import essential goods like fuel, medicine, and machinery. These shortages drive up the cost of imports, contributing to inflation. Moreover, the government’s complex foreign exchange management system, including multiple exchange rates, creates opportunities for arbitrage and corruption, further destabilizing the economy. Businesses and individuals often resort to parallel markets for forex, where rates are significantly higher, intensifying the inflationary spiral. - Supply chain disruptions

Transportation bottlenecks, aging infrastructure, and erratic electricity supply have disrupted production and supply chains across Zimbabwe. These factors limit the availability of goods and push up prices. The COVID-19 pandemic further exacerbated these challenges by restricting cross-border trade and inflating global shipping costs. The combination of domestic inefficiencies and global supply chain challenges has worsened inflation, particularly in the food and energy sectors, where prices are most volatile. - External factors

Global commodity price fluctuations and climate change have added layers of complexity to Zimbabwe’s inflation crisis. The country relies heavily on agricultural exports like tobacco, but recurring droughts and erratic rainfall, linked to climate change, have reduced output. On the global stage, rising fuel and fertilizer prices have raised input costs for local producers. These external shocks, combined with domestic vulnerabilities, underscore the interconnectedness of Zimbabwe’s economy with global markets.

Impacts of inflation

- Economic instability

High inflation erodes purchasing power, making it difficult for households and businesses to plan for the future. Savings lose value rapidly, discouraging investment in the formal banking sector. Economic instability deters both local and foreign investment, reducing the country’s growth potential. Businesses face the additional challenge of pricing goods in a volatile environment, further constraining economic activity.

Economic instability deters both local and foreign investment, reducing the country’s growth potential.

- Food insecurity

Inflation has disproportionately affected food prices, leaving many Zimbabweans struggling to afford basic necessities. The World Food Programme estimates that over half of Zimbabwe’s population faces food insecurity. Rising input costs for farmers and logistical hurdles exacerbate shortages, forcing families to cut back on meals and nutrition, particularly for children.

Zimbabwe’s food inflation raises concerns as it constitutes the bulk of household expenses

- Business challenges

Businesses in Zimbabwe operate in an environment of extreme uncertainty. Frequent price adjustments, unpredictable costs, and limited access to foreign exchange for imports make planning and growth nearly impossible. Small and medium-sized enterprises (SMEs) are particularly vulnerable, often shutting down due to unsustainable operating conditions.

Businesses in Zimbabwe operate in an environment of extreme uncertainty.

- Social unrest

Inflation exacerbates inequality, deepening the divide between the rich and poor. As prices rise, those with fixed incomes, such as pensioners and low-income households, suffer the most. This economic disenfranchisement fuels social unrest, with protests and strikes becoming a common response to economic grievances.

About twenty-two Children begging in Harare streets were handed over to Social welfare as Zimbabwe situation worsens

- Humanitarian crisis

Vulnerable populations, including the elderly, unemployed, and rural communities, bear the brunt of Zimbabwe’s inflation crisis. Access to healthcare, education, and housing diminishes as prices rise, creating a humanitarian emergency. This crisis further entrenches poverty and undermines long-term human development.

Scenarios

- Local businesses in Harare struggle to price imported goods amidst forex shortages, often resorting to the black market for currency, leading to higher costs being passed on to consumers.

- Families’ incomes are rapidly eroded, forcing them to forgo essentials like healthcare and education to prioritize food.

- Farmers in Masvingo face skyrocketing fertilizer prices due to inflation, limiting crop yields and threatening livelihoods.

Solutions and recommendations

- Monetary policy reforms

Zimbabwe must tighten its monetary policy by controlling the money supply and raising interest rates to curb inflation. The central bank should prioritize restoring confidence in the local currency through transparent practices and independent oversight. - Fiscal discipline

Reducing government spending and tackling budget deficits are critical. Streamlining subsidies, reducing corruption, and broadening the tax base can help Zimbabwe stabilize its fiscal position. - Foreign exchange management

Simplifying the foreign exchange system and ensuring equitable access to forex will reduce distortions in the economy. Supporting exports and attracting remittances can bolster foreign reserves. - Supply chain optimization

Investing in modern infrastructure, transportation networks, and energy systems will improve efficiency, reduce costs, and mitigate inflationary pressures. - Diversification and export-oriented growth

Encouraging investment in non-traditional export sectors, such as manufacturing and technology, can reduce reliance on volatile commodities, fostering economic resilience.

Opportunities and challenges

Opportunities:

- Agricultural growth through irrigation and climate-resilient crops

- Mining expansion leveraging rich mineral resources

- Tourism growth by promoting Zimbabwe’s iconic attractions

- Regional trade partnerships to access broader markets

Challenges:

- Infrastructure deficits, particularly in energy and transport

- Corruption, which erodes public trust and investment potential

- International isolation, necessitating better diplomatic engagement

Statistics

- Zimbabwe’s inflation rate reached 175 percent in 2020.

- The informal economy comprises 90 percent of employment.

- Over 70 percent of the population lives in poverty, highlighting the dire human toll.

Zimbabwe’s inflation crisis is a multifaceted problem requiring comprehensive solutions. While the challenges are immense, targeted reforms in monetary policy, fiscal discipline, and infrastructure development offer a path to stability. With strong governance and international cooperation, Zimbabwe can rebuild confidence, spur growth, and improve livelihoods.