KEY POINTS

- Zimbabwe allows 100% foreign ownership of mining rights.

- Investment licenses grant protections similar to local investors.

- The government emphasizes mineral beneficiation over indigenization.

According to a government official, Zimbabwe’s present investment rules provide international investors in the mining industry with several protections, including protection against expropriation.

Tax exemptions and incentives boost mining industry appeal

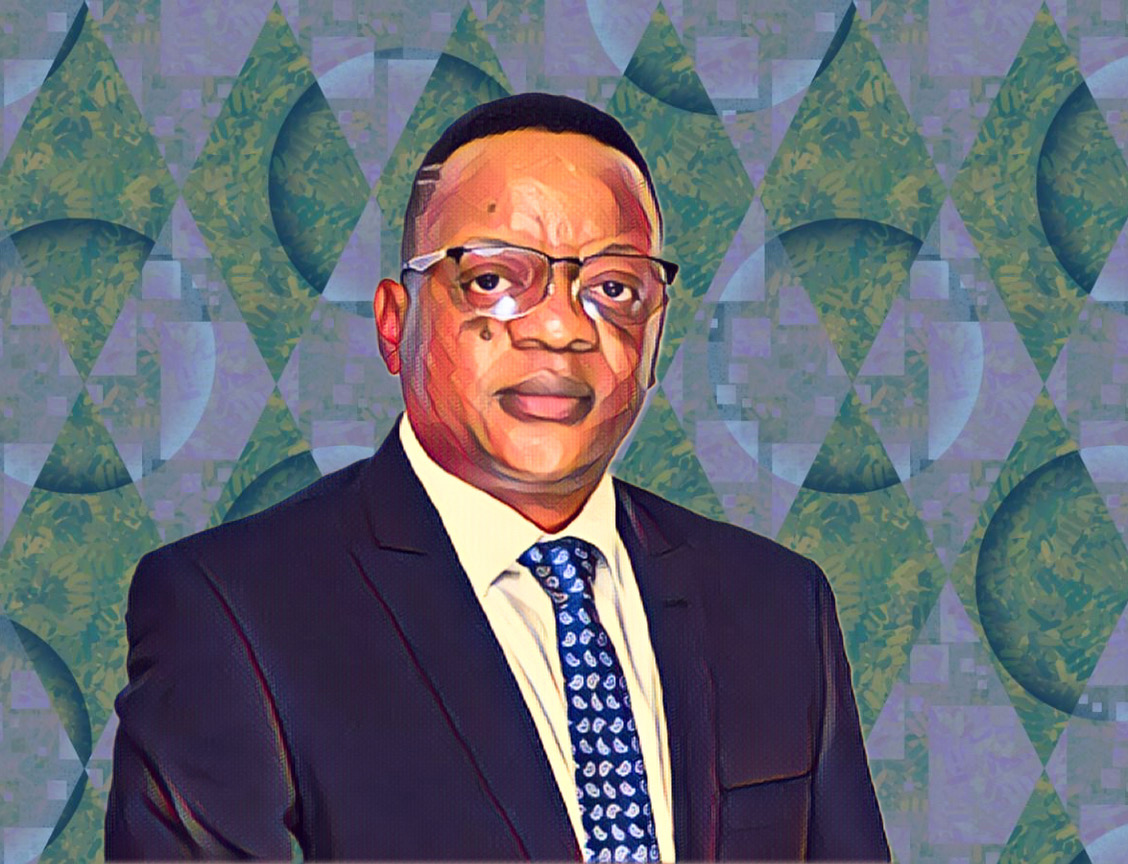

In an interview this week, Vusi Madzima, a legal investment advisor, talked about these incentives and protections, explaining how the nation’s regulations now permit foreign investors to possess all of the mining rights. These rights, which were formerly limited to 49% ownership for foreign entities, are now unfettered, enabling both local and international investors to fully own.

“Our laws are designed to address the issue of safety, which is a constant concern for investors, by securing foreign investments in Zimbabwe,” Madzima stated. He continued that the same protections as local investors, including access to legal remedies through Zimbabwe’s courts, are extended to foreign investors who possess the necessary investment licence. Furthermore, investors may return all money, dividends, and profits from registered investments to their home nations.

Zimbabwe shifts focus from indigenization to beneficiation

Zimbabwe now prioritises encouraging mineral beneficiation above rigidly enforcing indigenisation, notwithstanding its earlier legislation requiring partial local ownership of mining ventures. No minerals are currently earmarked for indigenisation, however, current policies allow the Minister of Mines to do so after consulting with the Minister of Finance.

Instead of exporting raw mineral ore, Madzima clarified, “The government’s emphasis now is on local beneficiation, encouraging companies to add value to minerals within Zimbabwe before exporting.”

In Zimbabwe, investors can purchase various mining titles, such as prospecting permits, registered claims, special grants, and mining leases. Due diligence obligations vary by title, particularly when differentiating between brownfield (previously developed) and greenfield (undeveloped) areas.

“A production due diligence is required for brownfields to compare projected and actual output, in addition to a financial review,” Madzima stated. He underlined that the investor, not the seller, should ideally commission geological surveys to confirm the availability of minerals in the designated area. Examining supporting paperwork is also crucial, including environmental impact studies, previous agreements, and court rulings that have an impact on the mining site.

Reduced tax rates and exemptions from import taxes on specific mining equipment are just two of the incentives the government provides to international investors in the mining sector. An additional inducement is a relaxation of prior indigenisation requirements, and investment licenses are accompanied by legal safeguards.

“Specific incentives can also be negotiated with the government for capital-intensive mining projects,” Madzima said, highlighting Zimbabwe’s dedication to luring and safeguarding international mining investments.