KEY POINTS

- Zimbabwe to resume debt talks this month, focusing on $21 billion in arrears.

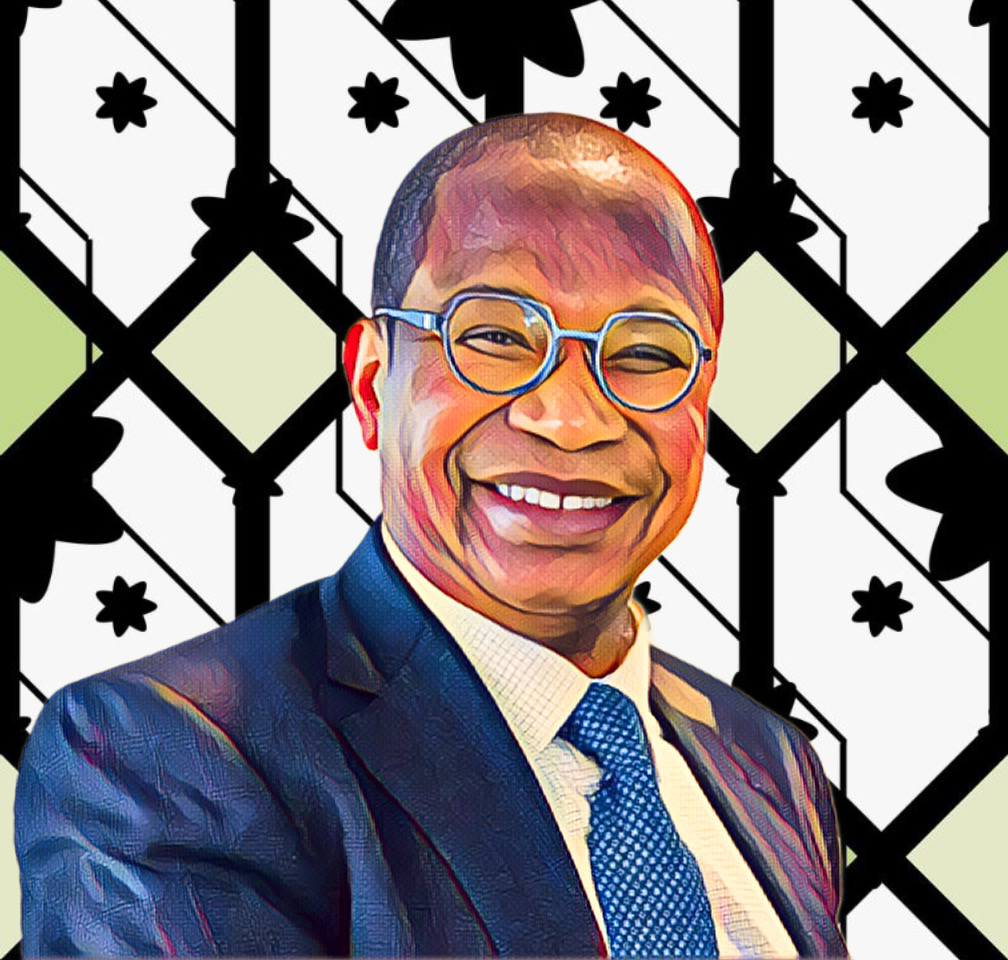

- International advisers, including AfDB’s Adesina, are guiding negotiations.

- The central bank will tighten monetary policy to manage inflation.

Renewed efforts to settle debt arrears

According to New Zimbabwe, Key figures in the debt restructuring talks include African Development Bank (AfDB) President Akinwumi Adesina and former Mozambican President Joaquim Chissano, whose support was enlisted by President Emmerson Mnangagwa in 2022.

Adesina and Chissano will guide discussions with creditors like the World Bank, the Paris Club, the European Investment Bank, and AfDB. In preparation, Zimbabwe recently hired financial advisers to assist with restructuring efforts, highlighting its commitment to overcoming its debt.

Due to its arrears, Zimbabwe has struggled to secure financing from international bodies such as the International Monetary Fund (IMF), forcing it to rely heavily on the central bank for funding.

Furthermore, this lack of external support has fanned inflation and strained Zimbabwe’s attempts to stabilize its currency, most recently the Zimbabwe Gold (ZiG), which launched in April as a replacement for the U.S. dollar in local transactions.

Central bank aims to stabilize economy

During the same seminar, Innocent Matshe, a Deputy Governor of the Reserve Bank of Zimbabwe, called on Ncube to concentrate his attention on measures, tied to the promotion of the extended usage of the Zimbabwe Gold (ZiG) in domestic transactions.

Yet, inflation has gone up to 37.2 percent in October from 5.8 percent in September, making the central bank to continue to impose a strict monetary policy into the next year.

This, Matshe noted, is due to monthly inflation’s correction expected figures which should be below 5 percent by the end of year and below 1 percent by 2025.

However, these talks can be considered harbingers for Zimbabwe , as it needs to regain the confidence of international lenders, fight inflation and return to foreign credit markets.