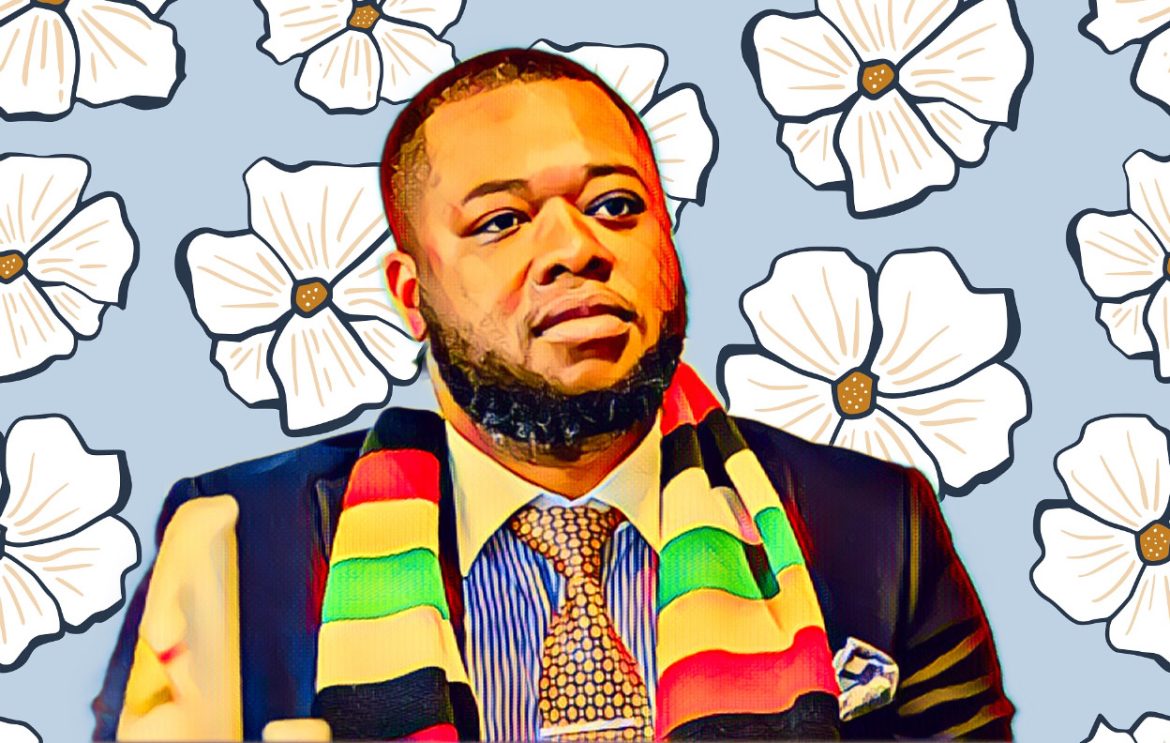

The Zimbabwe Gold (ZWG) currency is being carefully managed to maintain its value, Finance, Economic Development and Investment Promotion Deputy Minister David Mnangagwa confirmed. The introduction of ZWG in April, replacing the Zimdollar (ZWL$), has led to a shortage in the market, raising concerns about promoting the use of the U.S. dollar, which counters the government’s de-dollarization efforts.

Mnangagwa explained that the ZWG is being drip-fed into the economy to protect its value and prevent inflation. “What is happening now is different from the ZWL$ era,” he said. “Previously, people would quickly spend local currency to hedge against inflation. Now, with ZWG, people hold onto it because of its value, resulting in less circulation.”

The government and the Reserve Bank of Zimbabwe (RBZ) have previously stated that banks had enough ZWG to meet market demands. However, Mnangagwa noted that the central bank does not influence how banks disburse money. “Banks report that people are not withdrawing the notes and coins,” he said. “When you go to the bank, they say they don’t have enough, creating a situation that needs further investigation.”

Concerns about the cash shortage affecting businesses and consumers continue to rise. Mnangagwa dismissed speculations that the central bank instructed banks to limit ZWG cash and coin distributions. He emphasized the difficulty of enforcing such an order. To address the issue, the central bank introduced withdrawal spots for ZWG in different cities through Homelink.

Economist Vince Musewe highlighted the need to improve the money supply to support economic growth. “There should be adequate liquidity for people to save or transact. Cash is the energy of economic activity,” Musewe said. He pointed out that the current money supply is not meeting demand, which the RBZ must manage. The cautious release of ZWG aims to avoid parallel market issues.

While increasing money supply can lead to currency volatility, a shortage can hinder economic growth. Businesses and consumers may struggle to access necessary funds for investment and spending, slowing down economic activity and expansion.

The introduction of ZWG aims to stabilize the economy by maintaining currency value and reducing inflation risks. However, the current shortage highlights the challenges in balancing money supply with market demand. The government’s efforts to carefully manage ZWG distribution reflect a strategy to protect the currency’s value and support long-term economic stability.

The RBZ and government’s approach to drip-feeding ZWG into the economy aims to avoid past mistakes with the Zimdollar. The slower circulation of ZWG indicates increased confidence in its value but also creates liquidity challenges. As the government navigates these issues, the goal remains to support economic activity without triggering inflation or undermining currency stability.

Source: Newsday