China has offered Zimbabwe a glimmer of hope in its fight against crippling debt. The Asian nation recently canceled an unspecified amount of interest-free loans extended to Zimbabwe and pledged to collaborate on finding a solution to the country’s wider debt crisis. This news comes as Zimbabwe struggles with a total external debt of $12.7 billion, with China being its largest creditor outside the Paris Club.

Years of Debt Accumulation and Missed Payments

Zimbabwe’s debt woes stem from years of borrowing and missed repayments. The country’s economic turmoil under former President Robert Mugabe led to defaults on loans from multilateral creditors like the World Bank and the International Monetary Fund (IMF) since the early 2000s. This, in turn, limited Zimbabwe’s access to concessionary loans, forcing them to seek financing from alternative sources, often at higher interest rates.

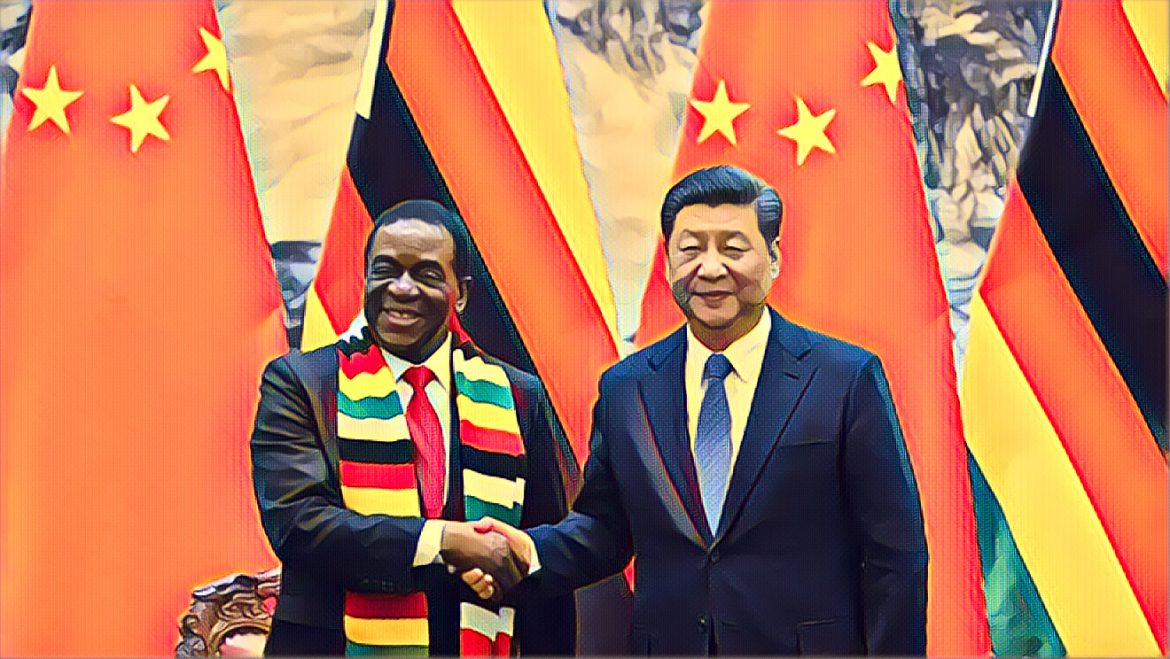

Following Mugabe’s ouster in 2017, President Emmerson Mnangagwa’s administration continued to borrow heavily from China, particularly for infrastructure projects. However, critics warn that this approach could lead Zimbabwe into a “debt trap,” where the country becomes reliant on China and unable to escape its financial obligations.

China Downplays Debt Trap Concerns, Offers Help

Chinese officials downplay these concerns, highlighting that China’s loans represent only 15% of Zimbabwe’s external debt, compared to 70% owed to Western institutions. They argue their recent debt cancellation and collaborative approach demonstrate China’s commitment to helping Zimbabwe navigate its financial challenges.

While China’s move offers some relief, the full extent of its impact remains unclear. The exact amount of canceled debt is unknown, and it may not significantly impact Zimbabwe’s overall debt burden. Additionally, the effectiveness of the planned debt resolution collaboration hinges on future negotiations.

Zimbabwean civil society organizations like the Zimbabwe Coalition on Debt and Development (Zimcodd) remain cautious. They warn that excessive borrowing, coupled with a shrinking economy, could leave Zimbabwe in a permanent “debt overhang” situation, hindering development and limiting access to future funding.

Looking Ahead: A Balancing Act for Zimbabwe

Zimbabwe faces a delicate balancing act. The country needs to find a way to service its existing debt while also investing in its economy and improving living standards for its citizens. Striking a sustainable path forward will require careful negotiation with creditors, responsible financial management, and economic growth.

Source: New Zimbabwe