Zimbabwe’s ongoing struggle with currency stability has taken a new turn. Street currency traders, a familiar sight in the country’s city centers, are abandoning their stalls and migrating to the digital realm. This shift comes in response to a heightened government crackdown on the unofficial foreign exchange market, which authorities blame for undermining the newly introduced gold-backed currency, the ZiG.

Defending the ZiG: A Battle Against Currency Instability

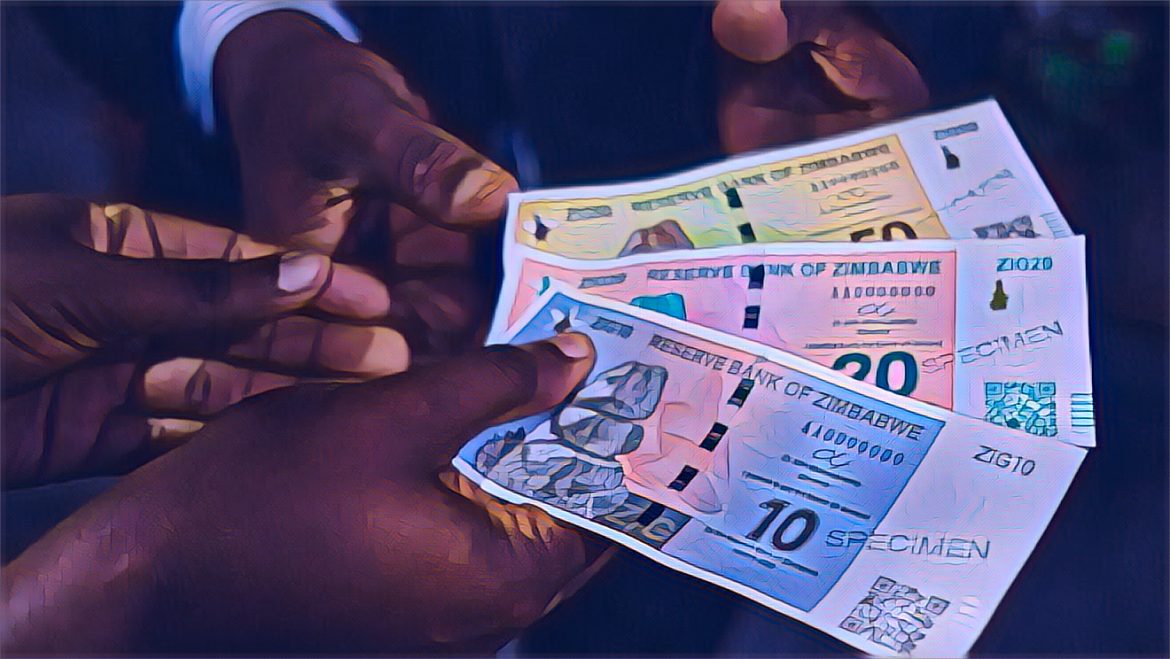

The Zimbabwean government is fiercely defending the ZiG, launched in April 2024, by targeting traders dealing in US dollars. These traders are accused of contributing to the hyperinflation that plagued the previous Zimbabwean dollar, which lost over 80% of its value against the US dollar earlier this year. The government hopes that by curbing unofficial US dollar trade, they can stabilize the ZiG and prevent a similar fate.

Following a brief period of disruption caused by the currency switch, street currency traders are finding new ways to conduct business. With the threat of arrest looming large, they have turned to WhatsApp, a popular messaging platform, to connect with trusted clients and continue their US dollar transactions. This shift highlights the resourceful nature of these traders and the challenges authorities face in regulating the foreign exchange market. On Wednesday, the exchange rate on WhatsApp stood at a staggering 17 ZiGs for one US dollar, a significant premium compared to the official market rate of 13.40 ZiGs.

Multi-Pronged Approach to Curb Black Market Activity

The Zimbabwean authorities are taking a multifaceted approach to address the unofficial foreign exchange market. Police statistics reveal a nationwide crackdown, with over 224 street traders arrested. The central bank is also playing a crucial role. Its financial intelligence unit has frozen nearly 90 bank accounts suspected of illicit transactions. Additionally, over 40 individuals have been fined for violating exchange control regulations, sending a clear message about the seriousness of the offense.

The recent arrest of Neville Mutsvangwa, son of a prominent cabinet minister, on charges of dealing in foreign currency since 2019, serves as a potent symbol of the government’s resolve. Mutsvangwa’s bail request was denied, and he will remain in custody until the end of May. This high-profile case sends a strong message that nobody is above the law when it comes to currency manipulation.

Finance Minister Mthuli Ncube reiterated the government’s unwavering commitment to stabilizing the ZiG. He vowed to counter any attempts to manipulate the currency’s value, emphasizing the government’s determination to ensure its success. Ncube’s remarks come amidst public concerns about the effectiveness of the crackdown and the long-term viability of the ZiG.

Uncertainties Remain: A Look Ahead

The success of the government’s strategy remains to be seen. While the crackdown may disrupt the operations of street currency traders in the short term, it’s unclear whether it can effectively address the underlying demand for US dollars. Furthermore, the reliance on WhatsApp for currency transactions raises concerns about transparency and potential for fraud.

Zimbabwe is not alone in its battle against currency instability. Many developing nations grapple with similar challenges. Learning from the experiences of other countries that have successfully implemented currency reforms could offer valuable insights. Additionally, fostering international cooperation and establishing a more robust and transparent financial system are crucial steps towards achieving long-term economic stability in Zimbabwe.

Source: New Zimbabwe