KEY POINTS

- ZimRe’s capital raise aims to strengthen the balance sheet.

- Botswana listing to unlock foreign investor confidence.

- Asset leverage is key to boosting shareholder returns.

ZimRe Holdings Ltd. is looking to raise up to $40 million through the listing of its reinsurance subsidiary, EmeritusRe International, on the Botswana Stock Exchange, a move aimed at strengthening its capital base and regaining competitiveness in the regional market.

The diversified financial services group consolidated its Botswana operations in 2023 after regulatory shifts allowed local underwriting. That merger formed EmeritusRe International, now the centerpiece of ZimRe’s capital-raising plan.

ZimRe eyes capital raise in Botswana

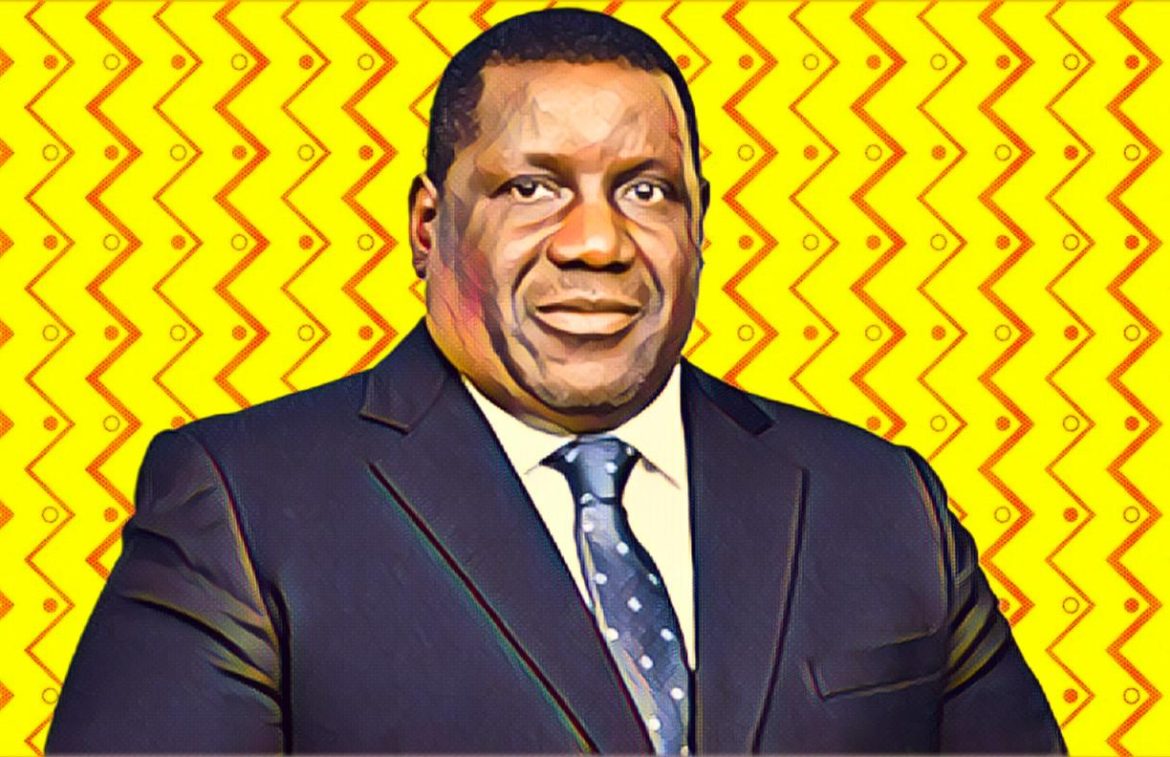

Stanley Kudenga, the Chief Executive Officer, confirmed that the group has already hired financial advisers and anticipates completion of most groundwork by year-end.

“We’re looking at raising between $30 million and $40 million,” Kudenga said during the company’s annual general meeting last Thursday. “Hopefully before Q1 next year, we’ll have clear direction.”

The listing is expected to provide ZimRe with much-needed capital to boost its balance sheet. Furthermore, this should improve its ratings, which are critical in the competitive reinsurance market, where firms often require strong financial backing to secure large underwriting mandates.

Capital raise to strengthen balance sheet rating

Kudenga emphasized that emerging from Zimbabwe, where macroeconomic volatility has taken its toll, ZimRe needs capital raised in a more stable environment like Botswana to compete effectively.

“Even the companies we reinsure in the region now have stronger balance sheets than us,” he said. “For us to become a major player again in Africa, we need a stronger balance sheet, and we can only get that through raising capital in a higher-rated jurisdiction.”

Moreover, the stability of Botswana’s financial environment, he added, gives investors more assurance than Zimbabwe currently can.

Optimisation, not just stability, drives growth strategy

ZimRe is also pursuing balance sheet optimization, seeking to move beyond just risk reduction to improving returns. Kudenga observed that the group’s assets heavily favor property. As of 2024, property holdings were valued at $87.02 million, accounting for nearly 40 percent of total assets.

“But property rentals are capped,” he said. “You can’t push them beyond 10 to 15 percent. So we need to leverage those assets more creatively to boost returns for shareholders.”

The group’s total assets stood at $223.04 million as of March 2025, a 7 percent increase from 2024, primarily due to operational cash flow.