Zimbabwe’s state sovereign wealth fund has announced that it has acquired 100% of Kuvimba Mining House Ltd., a company that holds some of the country’s most valuable mineral assets. The move comes amid persistent rumors that the company was secretly controlled by a tycoon with close ties to President Emmerson Mnangagwa.

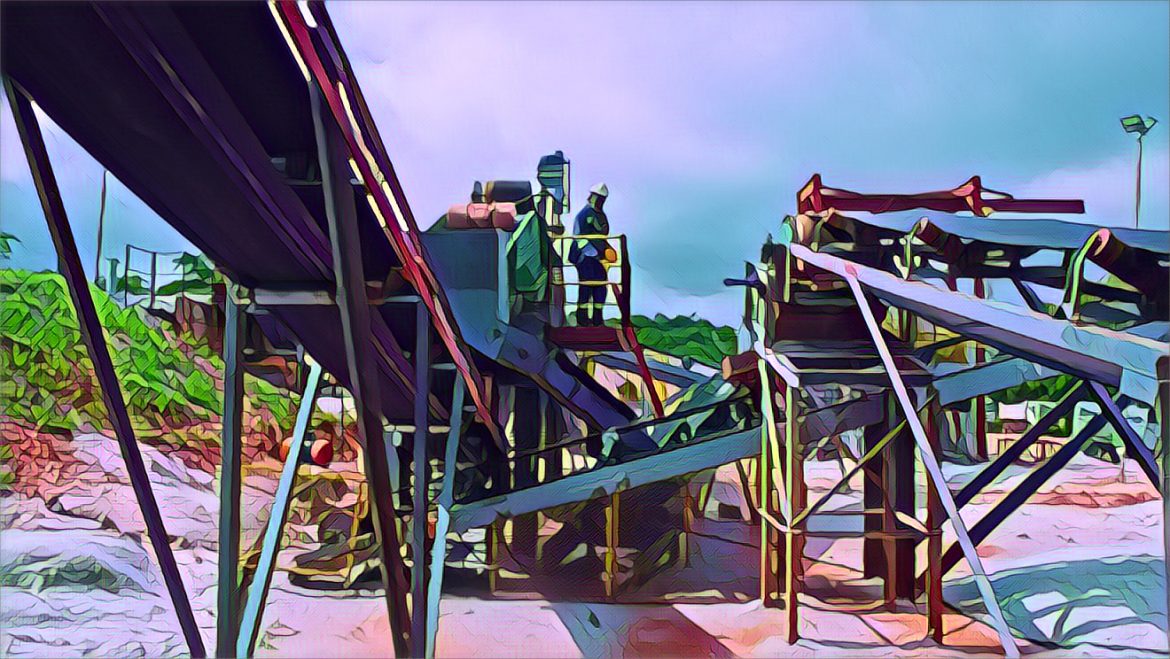

Kuvimba owns stakes in gold, nickel, platinum, lithium, and chrome mines, as well as a ferrochrome smelter. The company was formed in 2020 after the government took over the assets of Sotic International Ltd., a Mauritius-based firm that was sanctioned by the US and the UK for alleged corruption and links to Kudakwashe Tagwirei, a former adviser to Mnangagwa.

Tagwirei, who is also known as “Queen Bee” for his influence in Zimbabwean politics and business, has denied any involvement in Kuvimba and said he never benefited from its operations. However, several media reports have exposed the connections between Tagwirei and his associates and the mining company, raising questions about its ownership and transparency.

The government initially said that Kuvimba was 65% owned by the state and 35% by a private consortium of investors and managers. But in an interview with Bloomberg on Thursday, Kuvimba’s chief executive officer Simba Chinyemba said that the sovereign wealth fund, Mutapa Investment Fund, had bought out the private shareholders for an undisclosed amount.

Chinyemba said the deal was “very fresh” and that it was done to end the speculation and confusion about Kuvimba’s ownership. He also said that the company was planning to list on the Zimbabwe Stock Exchange and other regional bourses to attract more investors and boost its valuation.

Kuvimba’s assets are estimated to be worth more than $1 billion, according to the government, which has set a target of achieving a $12 billion mining industry by 2023. Zimbabwe, which is rich in natural resources, is trying to revive its economy after decades of mismanagement, hyperinflation, and sanctions.

The mining sector is seen as a key driver of growth and foreign currency earnings, but it also faces challenges such as power shortages, high costs, policy uncertainty, and environmental concerns. Some analysts have also criticized the government’s lack of accountability and transparency in the mining sector, especially regarding revenues and contracts.

Zimbabwe is not the only African country that has faced scrutiny over its mining deals. In recent years, several governments have tried to renegotiate or cancel contracts with foreign mining companies, citing allegations of corruption, tax evasion, environmental damage, or unfair terms. Some examples include Tanzania, Zambia, Congo, and Guinea.

However, some experts have also warned that such actions could deter foreign investment and undermine the rule of law. They have urged African governments to adopt more balanced and sustainable approaches to managing their mineral wealth while ensuring that the benefits are shared with the local communities and the wider society.

Source: Yahoo News Canada