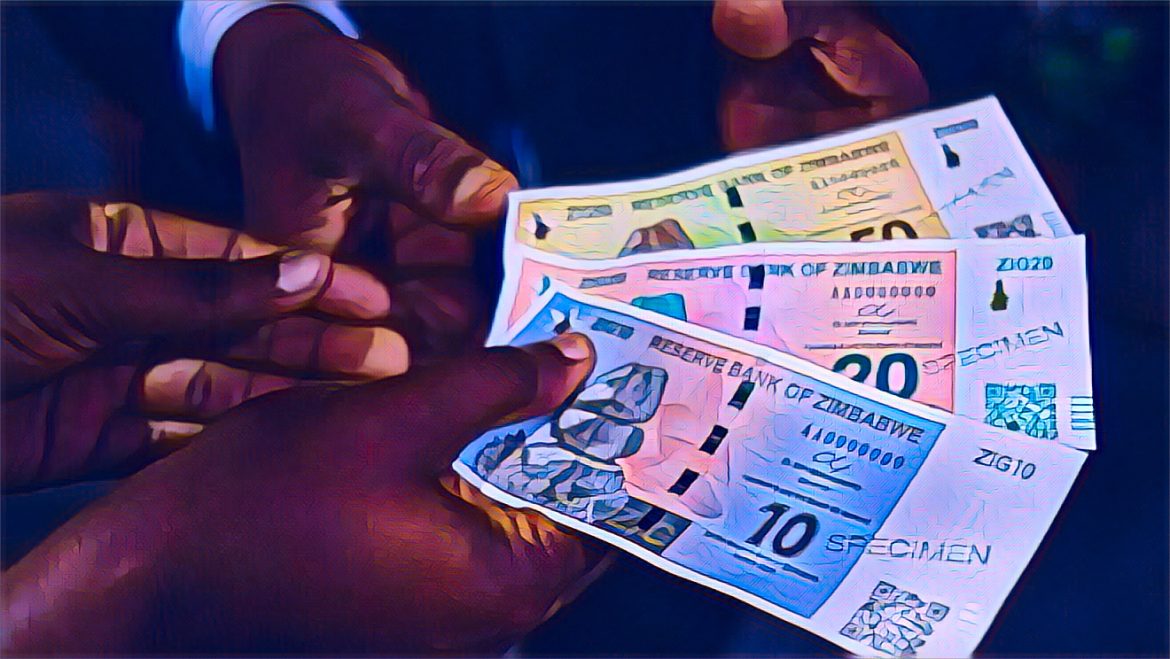

Zimbabwe’s economic landscape is witnessing a significant shift as the country’s gold-backed digital currency, the Zimbabwean Gold (ZiG), now accounts for 40% of all transactions. The adoption of ZiG, introduced by the Reserve Bank of Zimbabwe (RBZ) earlier this year, is part of the government’s broader efforts to stabilize the economy and combat the rampant inflation that has plagued the nation for years.

The ZiG, a unique digital currency backed by the country’s vast gold reserves, has quickly gained traction among Zimbabweans. It offers a more stable alternative to the Zimbabwean dollar (ZWL), which has been subject to severe depreciation and volatility. By pegging the ZiG to gold, the RBZ aims to restore public confidence in the nation’s currency and provide a reliable means of exchange that retains value over time.

The rapid adoption of ZiG reflects the growing distrust in traditional fiat currencies, particularly in economies like Zimbabwe’s, where hyperinflation has eroded purchasing power and led to widespread economic hardship. Zimbabweans have been quick to embrace this new form of currency, seeing it as a safer and more stable way to conduct everyday transactions.

According to the RBZ, the 40% market share held by ZiG in just a few months is a testament to its success and the public’s willingness to adopt innovative solutions in response to economic challenges. The central bank has also noted that the use of ZiG has been particularly prevalent in urban areas, where digital payment systems are more readily available.

The rise of ZiG has also had a noticeable impact on the broader financial ecosystem in Zimbabwe. Mobile money platforms and digital payment services have integrated ZiG into their systems, allowing users to seamlessly convert and transfer funds between ZiG and other currencies. This integration has further fueled the currency’s adoption and expanded its use beyond just retail transactions, including in larger business and cross-border deals.

However, while the introduction of ZiG has been met with optimism, challenges remain. Critics argue that the long-term success of the gold-backed currency depends on the RBZ’s ability to maintain sufficient gold reserves to support the currency’s value. Additionally, there are concerns about whether the government can sustain the current level of gold production needed to back the growing supply of ZiG.

Despite these challenges, the Zimbabwean government remains committed to the success of ZiG. The RBZ has announced plans to increase public awareness and education campaigns to further boost confidence in the digital currency. The central bank is also exploring partnerships with international financial institutions to enhance the credibility and stability of ZiG.

As Zimbabwe continues to navigate its complex economic landscape, the adoption of ZiG represents a significant development in the country’s financial system. With nearly half of all transactions now conducted using the gold-backed currency, ZiG has the potential to reshape Zimbabwe’s economy, offering a path toward greater stability and prosperity.

Source: NewZimbabwe.com