KEY POINTS

- Zimbabwe faces economic risks from Trump’s inward-looking policies.

- Domestic taxes are being used to fill healthcare funding gaps.

- Investor exodus compounds challenges for Zimbabwe’s fragile economy.

Zimbabwe is bracing for economic pressures stemming from newly inaugurated U.S. President Donald Trump’s inward-focused policies, which include higher interest rates, a stronger U.S. dollar, and the withdrawal from key international agreements.

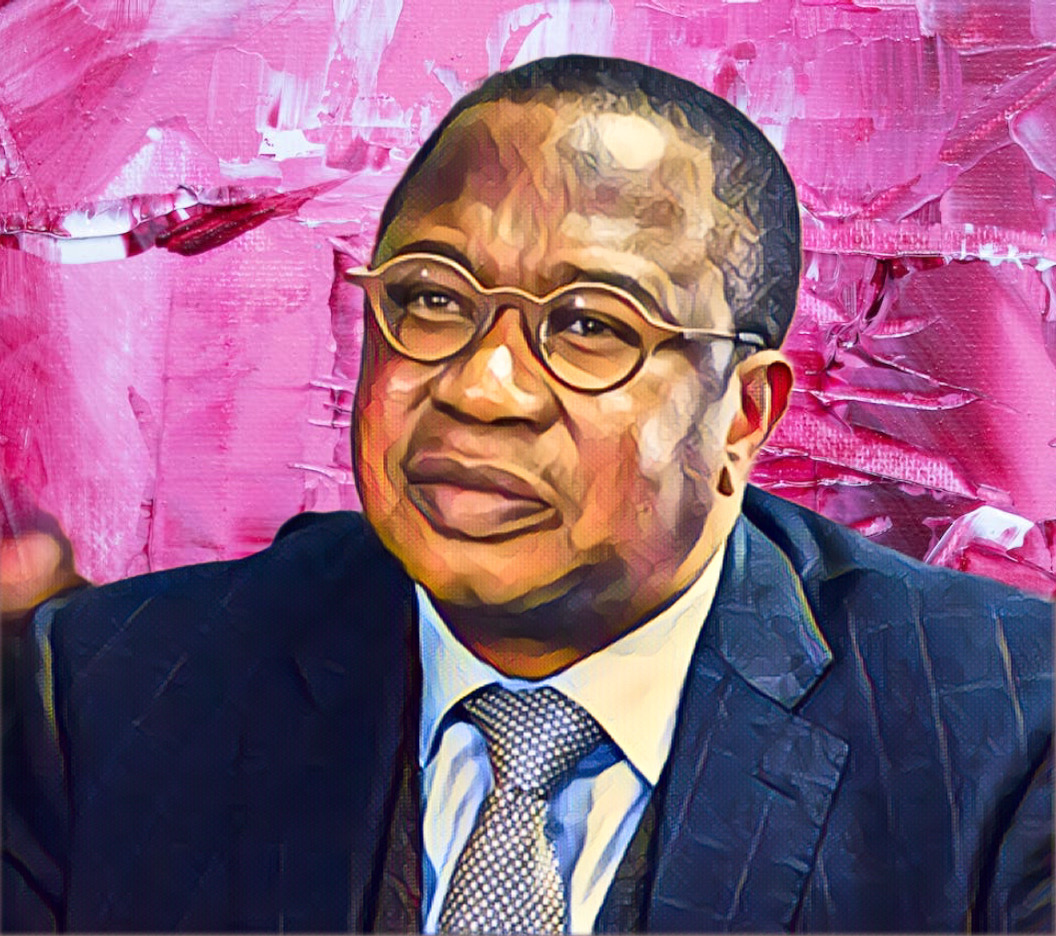

Zimbabwean Finance Minister Mthuli Ncube expressed concern that these shifts could destabilize emerging markets, including Zimbabwe, by affecting currencies, trade flows, and critical funding sources.

During a media briefing at the 2025 World Economic Forum (WEF) Annual Meetings in Davos, Ncube noted that a stronger U.S. dollar could encourage excessive imports, worsening current account deficits for nations like Zimbabwe.

“A stronger U.S. dollar will suck liquidity away and hurt emerging market currencies while capital exits these economies in search of U.S. treasury bills,” Ncube explained.

Rising economic pressures on emerging markets

Zimbabwe along with other emerging markets demonstrates intense concern regarding Trump’s unilateral United States withdrawal from the World Health Organization (WHO) since they depend heavily on global healthcare funding through the organization.

According to New Zimbabwe, Ncube warned that Zimbabwe will need to mobilize domestic resources to fill the gaps left by reduced external funding.

Zimbabwe has already implemented various taxes, such as levies on sugar, fast foods, airtime top-ups, and an AIDS levy, to generate revenue for the health sector.

Healthcare-specific funding is being used to acquire vital medical equipment together with cancer treatment devices.

“We must scale up our funding for health through domestic taxes to fill the gaps previously supported by international aid,” Ncube emphasized.

Struggling to stabilize the economy

The declining monetary base continues to be an extensive challenge for Zimbabwe. Extended economic turmoil forced many businesses to close entirely while causing international investors to leave Zimbabwe permanently

Businesses such as Standard Chartered followed a path of domestic divestment but some executives transitioned to managing operations locally.

The Zimbabwean minister identified Trump administration policies as obstacles to global trade operations that burden African economics.

Trump’s administration seems likely to reduce funding for key sectors, according to Ncube while increasing the likelihood that Zimbabwe will need to enhance its domestic resource generation capabilities.

Despite the challenges, Ncube reiterated the importance of finding innovative ways to sustain Zimbabwe’s economy.

“We discussed what Trump’s policies mean for global trade and relations, especially for Africa,” he said. “Zimbabwe needs to adjust its financial strategies to fight against worldwide economic challenges.”