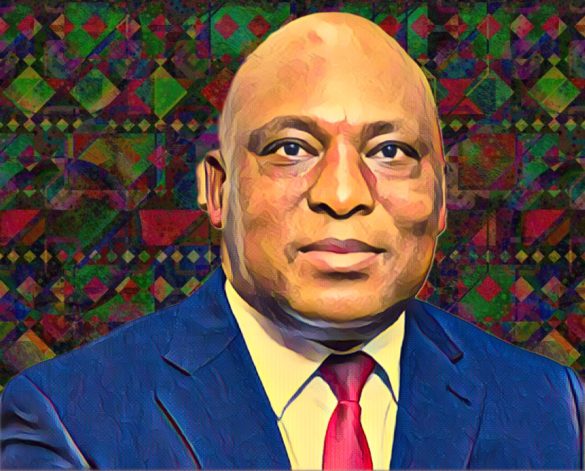

Zimbabwe’s central bank governor has raised concerns over potential deflationary pressures stemming from the nation’s robust ZIG (Zimbabwean Industrial Growth) index. Dr. Tafadzwa Matenda, the Governor of the Reserve Bank of Zimbabwe, highlighted the potential risks of deflation during a recent economic briefing.

The ZIG, which tracks the performance of Zimbabwe’s industrial sector, has been experiencing notable strength in recent months, driven by increased productivity and favorable economic policies. However, Dr. Matenda cautioned that while the current growth trajectory is positive, it also poses certain challenges, particularly in relation to inflation dynamics.

“We must be vigilant of the possibility of deflationary pressures arising from the strong performance of the ZIG index,” stated Dr. Matenda. “While the expansion of the industrial sector is undoubtedly beneficial for the economy, it also has the potential to exert downward pressure on prices, which could lead to deflation if not carefully managed.”

Deflation, characterized by a general decrease in prices, can have detrimental effects on an economy, including reduced consumer spending, lower business profits, and increased debt burdens. In response to these concerns, the central bank governor emphasized the importance of maintaining a balanced approach to monetary policy.

“We must ensure that our monetary policy remains flexible and adaptive to changing economic conditions,” Dr. Matenda remarked. “While it is essential to support continued growth and productivity, we must also be prepared to implement measures to mitigate the risk of deflation and ensure stability in prices.”

The governor’s remarks come amid a broader economic recovery in Zimbabwe, which has seen improvements in various sectors following a period of economic challenges. The government has implemented a range of reforms aimed at promoting investment, stimulating growth, and addressing structural issues within the economy.

In addition to the industrial sector, other key areas of focus include agriculture, mining, and tourism, all of which play significant roles in Zimbabwe’s economic landscape. Efforts to improve infrastructure, enhance regulatory frameworks, and attract foreign investment have also contributed to the country’s economic revival.

While acknowledging the progress made, Dr. Matenda underscored the need for continued vigilance and proactive measures to sustain the momentum of recovery. He called for collaboration between the government, private sector, and other stakeholders to address remaining challenges and capitalize on emerging opportunities.

“As we navigate the complexities of economic recovery, it is imperative that we remain proactive and forward-thinking,” Dr. Matenda emphasized. “By working together and maintaining a steadfast commitment to our economic goals, we can overcome challenges and build a prosperous future for Zimbabwe.”

In conclusion, while the strength of Zimbabwe’s industrial sector presents opportunities for growth, it also brings potential risks of deflation. The central bank governor’s warning highlights the importance of a balanced approach to monetary policy and proactive measures to ensure economic stability. With continued collaboration and determination, Zimbabwe can navigate these challenges and realize its full economic potential.

Source: New Zimbabwe